Singapore

Asia Pacific banks' cyclical pressures finally easing

But high private sector debt still a key risk.

Singapore delays bank capital rules implementation by a year

This follows the postponements by Hong Kong and Australia regulators.

UOB unveils fund transfer via messaging app

It is the first bank in Singapore to do so.

Banking risks in Asia Pacific finally stabilising as operating conditions improve

A total of 77% of bank rating outlooks in APAC are now stable.

Asian banks' liquidity coverage ratios exceed 100%

Funding and liquidity will remain Asian banks' credit strength.

Twenty-two more banks join the SWIFT gpi blockchain proof of concept

China Construction Bank, Sumitomo Mitsui, and Westpac are amongst the 22 banks.

DBS launches instant e-payment service for travel insurance

It is in collaboration with MSIG.

Find out how Diebold Nixdorf maintains market leadership in Asia

The company is spending heavily on R&D to better serve banks and retailers. With a presence in 130 countries and a share of one in three ATMs all over the world, Diebold Nixdorf has proven itself as a force to beat in the industry. Since Diebold and Wincor Nixdorf combined last year to form Diebold Nixdorf, the company has maintained market leadership in the Asia Pacific region, particularly in security, and has increased its installations to more than two million electronic points of sales (EPS) and ATMs supporting more than 25 languages and over 300 globally. Diebold Nixdorf boasts of a strong team in its regional headquarters in Singapore, where 25 countries are equally represented and where 4,000 technicians are connected as they move about in the field. The Singapore HQ also hosts a competitive and 65-strong research and development (R&D) division, which shares a hefty $200m budget with the rest of the Diebold Nixdorf offices. “In Singapore, if you're going to look from a retail perspective, we are number one. From a banking perspective we are number two, but if we look at what is being sold in a particular year in the last three years, we are pretty much leading out there. Every retailer in Changi airport is a Diebold Nixdorf customer,” says Andy Mattes, president and CEO, Diebold Nixdorf. Through its Connected Commerce headline, Diebold Nixdorf brings out the best of the overlap between banking, retail, and its consumers. It aims to enable connectivity across multiple channels, multiple venues, and take it to the next level. Mattes thinks that the company has done a really good transition from two companies down to one company. Diebold Nixdorf aims to be a services-led, software-enabled company. “The reason why services is the prime anchor is that the more you think about what's happening in our industry, the more you automate, the more banks go down this concept of branch automation, retailers go to the concept of self checkout. You change the complete paradigm of how you think about services. In the old days, the question is always, well if something happens, how fast will you be there to fix it? Or if you think about, we've automated the branch, we've automated the customer experience, it's not about how fast you fix it, it's all about how you can provide up to 99% uptime,” Mattes adds.

Weekly Global News Wrap Up: UK banks to justify consumer credit; Decline in correspondent banking not slowing

Find out why Frankfurt is dubbed as Brexit winner, and how mobile trumps branch visits.

Banks struggle to make digital sustainable

Those who excel in digital could reduce their costs by up to 30%.

Mobile payments boom as banks, fintechs collaborate

Find out how DBS, Maybank, OCBC, and Bangkok Bank partner with fintechs to bring a better user experience in the payments space.

Why humans remain key in banking cybersecurity

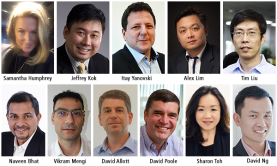

Find out why industry experts put a premium on the human factor in today’s digital times.

Singapore banks' loan growth to hit 6% in FY17

System loan growth moderated to 0.4% in May.

Bank of China launches debt capital market centre in Singapore

It will support the bank's strategy to broaden its investor base.

Singapore banks to be permitted to invest in e-commerce

Banks will not need to seek prior regulatory approval to do so.

Misys and D+H join forces to create the world's third largest fintech company

The new company will be called Finastra.

Advertise

Advertise