Malaysia

Hong Leong Bank exceeds forecast with $330m net profit in H1 2020

Provisions declined with Q2 2020 net credit cost at 5bp.

Hong Leong Bank exceeds forecast with $330m net profit in H1 2020

Provisions declined with Q2 2020 net credit cost at 5bp.

Goldman Sachs pleads not guilty in 1MDB bond sales fraud

The bank is accused of misleading investors on $6.5b in bond sales.

Malaysia pushes QR-payments adoption to combat cash reliance

The DuitNow QR System is a key factor to drive interest in cashless payments.

Malaysian banks boast ample capital despite higher buffer requirement

The central bank has currently set the countercyclical buffer at 0%.

Coronavirus will have little impact on Malaysian banks: analyst

Overnight policy rate cut and the 2019 nCov dented the sector.

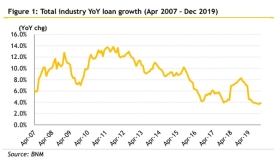

Chart of the Week: Malaysia's loan growth halved to 3.9% in 2019

Both household and non-household loan growth slowed.

Malaysian small lenders endangered by digital banks' entrance

More competition could jumpstart a build-up of debt within lower-income borrowers.

Grab, AirAsia, Razer in talks for Malaysian digital banking licence bid

Up to five licences will be granted to either conventional or Islamic banks.

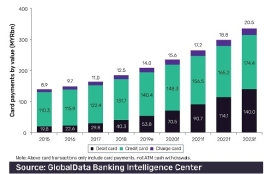

Chart of the Week: Malaysian card payments to hit $81b by 2023

The interchange fee cap and adoption of new financial tech is helping reduce cash reliance.

Malaysian banks' net profit to grow 4.8% in 2020: report

But NIMs are expected to taper off a further 3bps over the period.

CIMB allots $730m for corporate sustainable loans

Borrowers will receive interest rate rebates upon reaching pre-agreed targets.

Malaysian SMEs complete UOB-backed digitisation programme

It is expected to improve their productivity by up to 30%.

Malaysia's loan growth slows to 3.2% in October

Loan applications slimmed by 1.1% in the same month.

CIMB allocates $12m for micro SMEs

Micro SMES may received financing of up to $11,991.

Malaysia's central bank extends maximum tenor of repo to 5 years

This expands the previous deadline of only one year.

Malaysia's Islamic banks pull ahead of Indonesia in the digital curve

CIMB Group has pledged to invest $477m over the next five years to strengthen its digital platforms.

Malaysian banks still struggle with sluggish loan growth

Loans grew by just 3.8% in September amidst persistent weakness in business loans.

Advertise

Advertise