Lending & Credit

Everything you need to know about Indian banks' $191b 'zombie' debt

It's threatening the country's economic expansion.

Everything you need to know about Indian banks' $191b 'zombie' debt

It's threatening the country's economic expansion.

Banks may not be lending enough if bad debts don't rise during tough times

Singapore's central bank chief says they're probably not taking on sufficient risks.

Thai banks' lending growth to recover in the second half of 2017

Some banks announced lower loan rates for some customers in May.

Hong Kong banks raise mortgage rates

As the HKMA raised risk-weighted floor to 25% for new residential loans.

Chinese banks' average annual loan growth to hit 7% till 2020

Client loans could reach US$18.7t in 2017.

3 reasons why Japanese megabanks' shift towards subordinated loans for corporates is a good move

One of the reasons is that it supports risk-adjusted profitability.

Thai banks' asset growth hit new cycle low in March

No thanks to the sharp drop in interbank and derivative assets.

China banks' NPL ratio flat at 1.74% in Q1

Asset quality has largely stabilised.

Large state-owned banks in China conservative in recognising NPLs

But NPL formation has moderated since 2H16.

Indian regulators intensify efforts to solve banks' bad loan problems

Asset resolution will be a dominant theme in the sector over the next few years.

China regulator launches emergency risk assessments for banks' lending practices

It will include the banks' issuances of negotiable certificate of deposits.

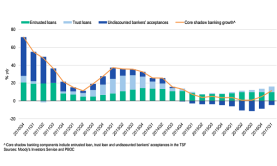

Chart of the Week: Core shadow banking activities in China rebound in Q1

That is after slowing to a near stall in 2016.

Risks rise as Chinese lenders ditch struggling corporates for retail borrowers

The switch is fuelling an unusual jump in home loans.

How does the tight systemic liquidity affect China's shadow banking sector?

Stricter regulations aim to constrain the growth of leverage in the country.

Chinese regulators to increase scrutiny of the shadow banking sector

These new measures are likely to be negative for corporate bonds.

China's off-balance sheet lending surged $109b in March

Bloomberg says China’s shadow banking is back in full swing.

Australian banks' profitability to suffer from tighter mortgage lending standards

The share of new loans with high loan-to-value ratio fell to 22.3% in December.

Advertise

Advertise