Financial Technology

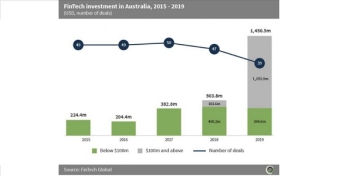

Australian fintech firms raise over $2.7b from 2015-2019

Deals over $100m comprised 41.9% of capital raised.

Australian fintech firms raise over $2.7b from 2015-2019

Deals over $100m comprised 41.9% of capital raised.

TransferWise launches mobile phone money transfer service in Singapore

Customers with a PayNow profile no longer need to input their bank account number.

Standard Chartered floats cross-border payments tracking portal

It is the first bank to launch a public platform for payments tracking.

Seafarer-focused e-money app MarCoPay obtains licence in the Philippines

The app will use QR codes to help seafarers manage and remit salaries.

AI is top fintech trend of 2019: study

The value of AI in the fintech market is expected to rise four times by end-2024.

Denmark's Saxo Bank establishes joint fintech venture with Chinese auto firm Geely

It will provide financial and regulatory tech solutions to banks and fintechs in China.

How foreign fintechs will buoy Japan's banking sector

They might introduce new business models and solve overcapacity, says a former central bank deputy governor.

400 million wearables could be converted for smart payments push by 2022

Mastercard and Tappy are using token technology to allow payments using accessories.

Singapore crowned as APAC's fintech leader

In APAC, only Singapore and Indian cities made it into the global top ten.

Citibank rolls out one-stop mobile account app

Applications can be completed in a minimum of 10 minutes.

Liquid, Asia United Bank launch cross-border QR payments service

This will enable cross-border transactions between Singapore and the Philippines.

Tribe raises $21.5m to boost market-ready blockchain tech

The firm is focused on expanding its technology and applications by 2020.

Fintech firm Thunes clinches Singapore payments licence

With the new licence, it can now facilitate transactions in its digital membership network.

China to launch industry standards for fintech

The project will have a focus on data security and address weaknesses in the financial sector.

Fintech startup GoBear's two co-founders to step down

This follows the resignation of former CEO Andre Hesselink in 2018.

How GoBear expanded beyond financial comparison

It plans to enter partnerships to develop bespoke insurance solutions.

How kakaobank successfully cracked the profitability code two years after rocket launch

In the first half of the year ended June 31, kakaobank hauled net income of KRW10b ($8.58m), booking net profit for the first time following a...

Advertise

Advertise